The Edge Centurion Club 2024 : HIGHEST RETURNS TO SHAREHOLDERS OVER THREE YEARS

The quiet titan of Malaysia’s consumer sector

Chester Tay / The Edge Malaysia

August 2024

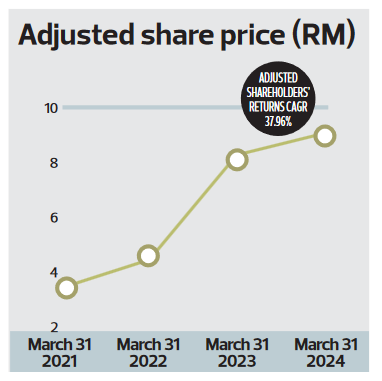

IN THE CROWDED landscape of the country’s consumer products and services sector, one company has quietly outshone its peers: trading and distribution outfit Harrisons Holdings (M) Bhd (KL:HARISON).Over the past few years, Harrisons has been delivering both revenue and profit growth, even during the disruptive pandemic. The company,which took home the Highest Growth in Profit after Tax over Three Years award under the consumer products and services sector two years ago for stellar profit growth between 2018 and 2021, has continued to see net profit growth, charting record profits and revenue yearly from 2021. Net profit for its fiscal year ending Dec 31, 2022 (FY2022), jumped 60% to a new high of RM66.7 million from RM41.7 million in FY2021, as revenue broke the previous year’s record, climbing to RM2.17 billion from RM1.93 billion.For FY2023,net profit reached a new peak of RM67.4 million, as revenue climbed further to RM2.26 billion. Even without a dividend policy, the company has been making decent payouts. From annual payouts of 20 sen per share in FY2019 and FY2020, its dividend payout rose to 30 sen per share for FY2021,and then 50 sen per share in FY2022 and FY2023. In tandem with its strong profit growth and increasing dividend payouts, Harrisons’ share price charted significant growth over the last three years. It jumped from RM3.46 (adjusted) on March 31,2021,to RM9.09 by March 31,2024. For an adjusted compound annual growth rate in Teo Seng being the winner of the Highest Growth In Profit After Tax Over Three Years award under the consumer products and services category of The Edge Malaysia Centurion Club Corporate Awards 2024,with an adjusted compound annual growth rate of 140.3%. The group recognised a government subsidy of RM104.76 million under Program Subsidi Ayam dan Telur in FY2023. The objective of the of 37.96% over the three years. This clinched the company the award for Highest Returns to Shareholders Over Three Years at The Edge Malaysia Centurion Club Corporate Awards 2024. Harrisons is 42.33% controlled by Bumi Raya International Holding Co Ltd, which has itsroots in Indonesia and is primarily involved in the trading of consumer, engineering and chemical products,as well as building materials. It is linked to the Bumi Raya Utama Group

Harrisons’ strong performance over the years can be attributed to its diversified portfolio. The group’s income is mainly derived from the marketing, sales, warehousing and distribution of consumer, building materials and engineering products, fine wines, agricultural and industrial chemicals, the operation of shipping/logistics, travel agencies and retailing.

These are grouped into three main segments: (i) trade and distribution, which comprises mainly fast-moving consumer goods (FMCG) in Sabah and Sarawak, and building materials